In September 2015, in the United States a group of players belonging to all commercial refrigeration links announced the foundation of a no-profit association called North American Sustainable Refrigeration Council (NASRC)

In September 2015, in the United States a group of players belonging to all commercial refrigeration links announced the foundation of a no-profit association called North American Sustainable Refrigeration Council (NASRC)

The mission of such association was “helping supermarkets in the transition towards natural refrigerants, more sustainable for the climate”. Since its establishment, the network and the driving force of the Association have notably grown and today it counts almost 20% more of members, it represents over 24,000 supermarkets’ stores in North America, which constitute more than 60% of stores in the United States and include both national/regional chains and independent brands; besides, it is joined by 125 organizations of each sector of the commercial refrigeration industry.

Its targets: bring together stakeholders who believe the progress of natural refrigerants is advantageous for environment and business because, although today there are tested technologies that use natural refrigerants, it is necessary to reach scale economies to exert an important impact on the sector’s climatic footprint.

Its founders can boast some of the outstanding names of the North American commercial refrigeration sector, for instance: Whole Foods Market, Hillphoenix, Danfoss, Carter Retail Equipment, True Manufacturing, Parker Hannifin, KW Refrigerant Management Strategy and Source Refrigeration & HVAC, Inc.. NASRC counts members also in Canada and Mexico but the majority is concentrated in the United States and for this reason the association identifies here its main action area for the adoption of natural refrigerants.

NASRC is, in hindsight, one of the few no- profit organizations that in North America take care of spreading the natural refrigerant culture. Retail is specifically the focus of this association’s attention. Danielle Wright, Executive Director of NASRC, explains us why.

Why do you focus your attention mainly on supermarkets?

NASRC was founded by people coming from the commercial refrigeration sector, worried for the slow adoption rate of natural refrigerants. They saw how supermarkets must face a series of hindrances in the adoption of natural refrigerants and they identified in this a cooperation opportunity for industry to overcome obstacles. We were born precisely for that and bringing industry together to make progresses is fundamental for our mission.

One of your goals is “eliminating the barriers that prevent the widespread adoption of natural refrigerants in supermarkets “. What are the main barriers?

The work in strict contact with our Group’s member retailers highlights that the primary challenges are the initial cost, the reliability of information and the availability of services, all elements that are connected one another and create a negative vicious circle. If we can face these three challenges simultaneously, we can reverse the cycle to drive the adoption volume and scale economies. This is the key to speed up the adoption of natural refrigerants in the United States.

In terms of cost, how do natural refrigerant plants behave in comparison with standard ones?

Here in the United States, natural refrigeration systems have a higher initial investment cost than conventional HFC systems. Moreover, there are very few data about current costs of service, maintenance and energy. We are working at these fundamental problems to find a solution.

How are the prices of refrigerants evolving in the United States?

While natural refrigerants like CO2, ammonia and propane are less expensive per pound compared to HFC, there is often an availability problem. Not all wholesalers or distributors stock up natural refrigerants, which can imply a cost rise if a retailer must pay for the stocking up and the rental of gas containers within reach.

What is the availability of components for natural refrigerants?

The availability of components can be a problem, depending on the position, but we expect the problem will diminish when the demand for these systems will increase.

What role does energy efficiency play as cost factor?

Energy costs are an important element in operational costs overall, and this is true for any retailer. Nevertheless, energy prices notably vary from State to State and then energy will have higher priority in places like California, New York and Hawaii, which have a high cost per kW and demand peak costs. In some States, supermarkets are called to face regulatory pressures to reduce their energy consumptions while the efforts to decrease carbon emissions are spreading.

The growth you have experimented as association is certainly a mirror of end-users’ risen interest in natural refrigeration. How is the natural refrigeration application in United States supermarkets developing?

The growth you have experimented as association is certainly a mirror of end-users’ risen interest in natural refrigeration. How is the natural refrigeration application in United States supermarkets developing?

Certainly, the market of natural refrigerants has significantly grown in the last 5 years. However, I would ascribe the interest growth to regulatory pressures. A rising number of retailers is in search of solutions to address the new regulations about refrigerants and, at the end, our work will help them.

How is the industry that offers natural solutions growing?

The applications of natural refrigerants in new constructions have become more largely available and some types of systems are approaching the same costs as for standard HFC systems. However, the growth rate for new constructions is almost flat, just by 1-2% yearly. The outstanding opportunity and challenge is the conversion of existing structures into natural refrigerant plants, thing that is not always feasible economically or technically. In terms of technology at the retail’s disposal, the major offer concerns CO2 but many retailers are also exploring R290 solutions in hermetically sealed appliances. Other available solutions on the market are plants with low ammonia charges in cascade or with secondary systems.

Concerning regulations, it is difficult to speak of the United States in their whole because each State has its own regulation. However, is it possible to see, in some ways, a direction? How many States are introducing regulations to facilitate the introduction of a sustainable refrigeration?

The federal action for regulations on refrigerant was suspended under the current administration. At present (April 2020) Unites States must still ratify Kigali amendment, even if we expect it is just a matter of time. In the meantime, some States are carrying on some actions in the context of the US Climate Alliance to reach the targets of the Paris Climate Agreement. Numerous States have accepted engagements for the gradual elimination of HFC, but only few have proceeded with significant regulations (for instance, California). The concern in the whole sector is that a mosaic of state regulations might create confusion in the market and be complicated for the companies that operate in more States.

What is US Climate Alliance doing?

What is US Climate Alliance doing?

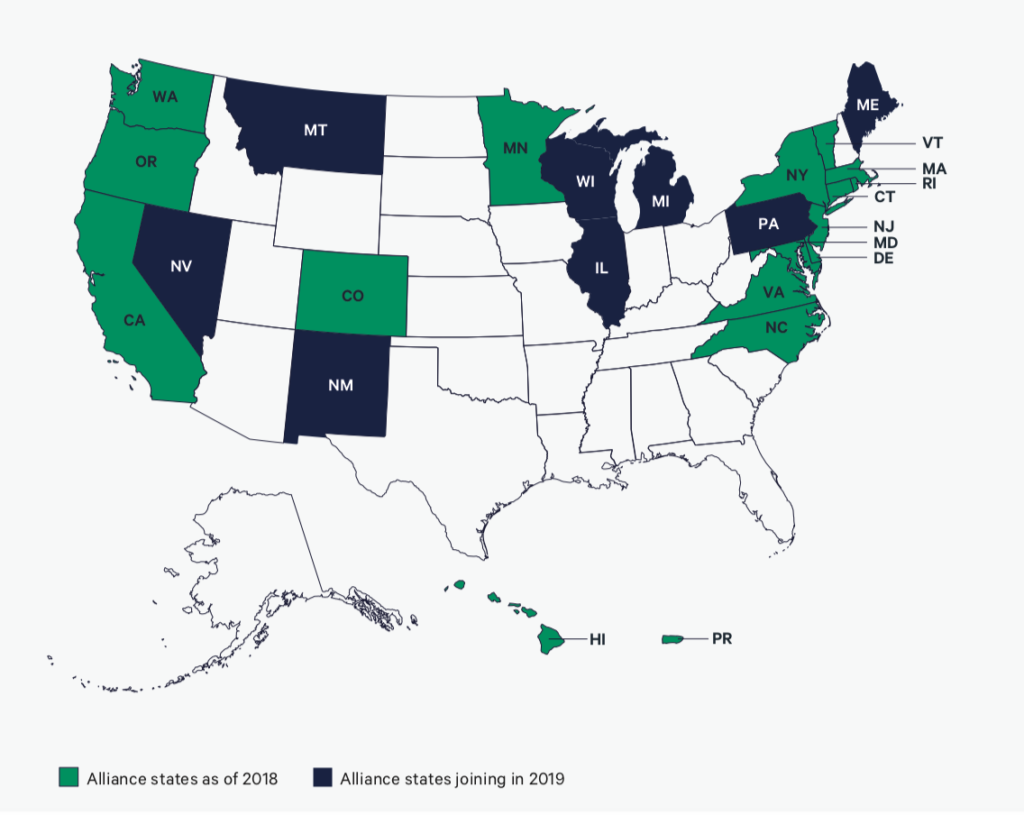

The goal of US Climate Alliance (USCA) is creating coherence in absence of Federal Government’s regulations. Wherever possible, USCA States will aim at an alignment in their policies. Currently, 15 States have made commitments to reduce HFC emissions. Their first step will be the support of SNAP US EPA regulations that forbade the use of refrigerants with high GWP (R-404A and R-507A) commonly used today. However, some States have established more ambitious targets (for instance California) to further reduce HFC emissions and will integrate regulations that impose refrigerants <150 GWP (i.e. essentially natural refrigerants).

In the United States, other initiatives aim at orienting the market towards refrigerants with low GWP. I think for instance of the Green Chill Partnership of EPA…

Many of our retailer members participate also in the Greenchill partnership and we support them whenever it is possible. Greenchill, for instance, asked us to present, on behalf of them, one of the next webinars on boosting opportunities for the natural refrigerant. We will do that.

How do you judge Europe and its regulation on fluorinated gases?

Europe is far ahead in terms of adoption of natural refrigeration technologies and problem-solving, as the technicians’ training and energy performances. I believe we can ascribe this progress also to the regulations on fluorinated gases, which have provided a clear direction and certainty for the market.

————————————————–

The Naturally Cool Movement

In recent years, NASRC has achieved broad growing support by stakeholders in the supermarket sector, as they have dedicated time and energy to the Association’s mission. Even continuing to work in the front of those who own, manage and install plants and of their political decision-makers, also for NASRC has come the time of opening new frontiers to widen the activity of awareness- raising on the advantages of the natural refrigeration, taking into account the pressing climatic urgency. For this reason, NASRC has started addressing a wider public who involves also consumers, i.e. those who make use of supermarkets for their daily routine. We perfectly know the public opinion’s power in directing B2C companies’ choices.

The answer to this awareness was the birth of the Naturally Cool movement, conceived to expand the support towards the natural refrigeration industry, to increase the public’s awareness and then to intercept its support.

You can find more information about the movement’s initiatives in Linkedin in the Naturally Cool Forum group or here: http://nasrc.org

———————————————–

———————————————

NASRC: a platform to favour the diffusion of natural refrigeration technologies in Retail

The North American Sustainable Refrigeration Council (NASRC) has announced the intention of releasing an Aggregated Incentives Program (AIP), a programme of incentive aggregation designed to accelerate the funds for natural refrigeration technologies. The programme will provide a platform to coordinate various funding sources and to simply the process of incentive demand for the retail. AIP will be first tested in California, with the aim of expanding then the programme on a national scale in the future.

«Few retailers have the resources to devise the definition of new projects, owing to what is happening in this time. However, we would like to inform them we are getting ready for the future and we will guarantee the programme provides them with the highest possible support when times will be right» Danielle Wright, executive director NASRC stated.

«The high initial cost of plants is the main hindrance that prevents from adopting low GWP technologies» Wright declared. «The financial support to compensate initial costs is the key to fill the gap and to boost the necessary scale economies to decrease initial costs».

AIP will operate by bringing together various funding sources for projects that encompass technologies with very low GWP. The programme addresses both new and existing plants. Funds will be allocated according to the reduction of direct greenhouse-effect gas emissions by the refrigerant and other benefits, like energy efficiency or water saving.

«Our target is maximizing the funding per project, meanwhile simplifying the demand process for the retailer» Wright stated. The initial pilot programme will be offered free to candidates, thanks to the generous sponsorship by NASRC Titanium members, such as BITZER US, Climate Pros, CoolSys and Hillphoenix.

Another target of the pilot project is increasing the number of funders and the amount of funds allocated to support technological installations with low GWP. «The best way to guarantee continuous extended state funding is proving there is demand» Wright affirmed. «We are encouraging retailers and their partners to submit demands not only for the projects planned for next year but for the next 5-10 years».

———————————————-

——————————————

About US Climate Alliance

In June 2017, the governors of California, New York and Washington set up the US Climate Alliance, a coalition of governors committed to the transition towards a green economy and the achievement of Paris Agreement targets about climate changes. In about two years, this coalition has grown to the extent of reaching the number of twenty-five governors, both democratic and republican, who represent 55% of United States’ population and 60% of United States’ GDP. Puerto Rico is member of this coalition, too.

These twenty-five states and territories are different, as the nation itself, and represent the main urban areas and small cities, coastal communities and farmers in the heart of America. Through a pondered coordinated State action, these governors fill the gap of the federal leadership, with the target of reducing their collective greenhouse emissions (GHG) by at least 26-28% under 2005-levels within 2025, where some have fundamentally more ambitious goals of emission reductions. Generating 40% of GHG emissions of the United States, this coalition is equivalent to the sixth biggest emitter in the world. Today, the Alliance has become an entity of global relevance, able to exert a real impact on global emissions through its leadership. Some States, in their emission reduction programmes, have expressly indicated their intention of reaching a decrease of HFC emissions.

More information: https://www.usclimatealliance.org/

——————————————————

—————————————-

What is the US GreenChill Partnership of EPA?

The GreenChill Partnership of the Environmental Protection Agency (EPA) in United States is an initiative addressing supermarkets to decrease refrigerant emissions and to reduce their impact on the environment. GreenChill is joined by stakeholders to share information and good practices pertaining to the sector, and to support supermarkets’ efforts to decrease refrigerant emissions. The activities of GreenChill are carried out through three programmes:

- The programme of corporate emission reduction,

- the programme of store certification and

- the advanced refrigeration programme.

The supermarkets that become partners of GreenChill fix yearly programmes of emission reduction and highlight their progresses to EPA every year. Partners attend roundtables for the information exchange, educational webinars and after sale service development. GreenChill activities support a better refrigeration management and the transition towards advanced refrigeration technologies.

More information: https://www.epa.gov/greenchill

—————————————————

————————————————–

USA: Trends in the use of natural refrigerants

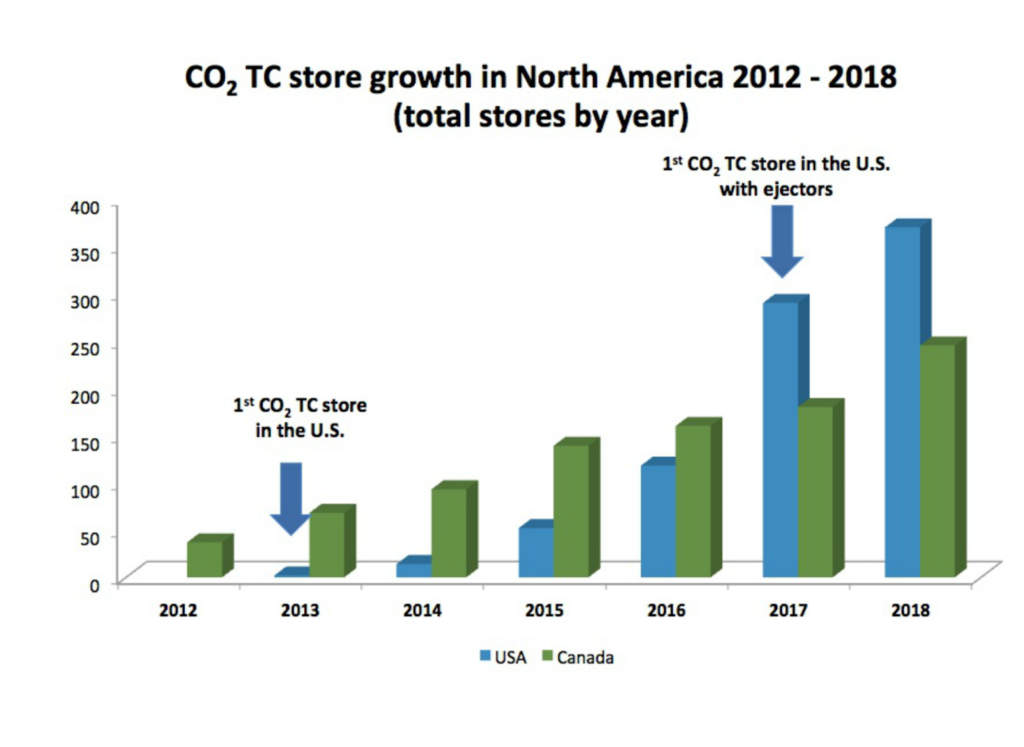

United States started decisively late compared to Europe in installing transcritical CO2 plants in supermarkets. According to the data presented by Shecco in a 2019-webinar by EPA, the first supermarket with transcritical CO2 in the USA was installed in 2013; the first plant with ejector arrived in 2017. The growth trend is certainly rising. According to the data by Shecco, in 2018 transcritical CO2 supermarkets in USA were slightly under 400, a growing trend but still a relatively low percentage out of the total of United States stores: it is estimated that today CO2 is present in 1-2% of United States supermarkets. In Europe, to make a comparison, the penetration is likely to be around 14%. Therefore, the potential of this market in the United States is high.

Concerning hydrocarbon applications, lively interest is aroused by R290 sealed appliances, deemed excellent partial or complete solutions for the supermarket. The driving engine of this interest is certainly the efficiency of refrigerant and of applications. Growing interest in the water loop technology, too, considered efficient, easily installed and maintained. In 2018, according to Shecco data, about 100 units were present on the United States’ market.

About 220+ the plants with low ammonia charge in cascade with CO2 or other refrigerants, figure that however includes also refrigerated warehouses and food production plants.

————————————-